The need for this blog was promoted by a meeting I observed in a coffee shop today. It appeared that a local wine producer had engaged an Asian graphic designer/translator to develop a Chinese version of his packaging and his marketing materials…but clearly he doesn’t get China and his advisor, I assume, was just telling him what he wanted to hear. It appeared that getting ready for China to him was about translation and not branding.

The need for this blog was promoted by a meeting I observed in a coffee shop today. It appeared that a local wine producer had engaged an Asian graphic designer/translator to develop a Chinese version of his packaging and his marketing materials…but clearly he doesn’t get China and his advisor, I assume, was just telling him what he wanted to hear. It appeared that getting ready for China to him was about translation and not branding.

All I needed to see were the new labels for his wine…they looked exactly like the Australian ones with Chinese Characters. Why is that an issue.? Well his labels are all solid black with white writing. The worst colour combination for China.

Chinese would look at that label and assume if they drank it they would die…as that’s what Black in China represents.

The message here is unless you have a very strong, successful and highly sought after Western Brand you are going to need some drastic rebranding for China.

Selling in China is more about understanding the business and consumer culture rather than just translating the words and images. So it is vital to hire a trusted advisor who has lived as an adult in China (not just have a China Passport) and will tell you what to do to be successful not just translate the words etc and do what you think you need to do.

Talking about wine there is a great market for premium Australian wine in China but it needs to be done well as the following report on a recent presentation highlights:

Marketing more premium vintages to meet the demands of China’s expanding middle class could give Australian wine producers an edge over their competitors.

That’s according to NAB’s head of industry analysis, Dean Pearson, who spoke at the recent Savour Australia wine conference in Adelaide.

Wine sales in China are expected to increase 50 per cent between 2013 and 2016, with demand largely driven by the rapidly expanding middle class, according to NAB.

“While demand for this premium product is still in its infancy, it presents an opportunity for substantial growth in China moving forward,” Mr Pearson said.

According to the NAB Rural Commodities Wrap from July 2013, global wine consumption is forecast to increase by five per cent between 2012 and 2016.

By then, wine sales in China are expected to overtake France, which would make China the second biggest wine consuming country in the world, behind the United States.

“The value of Australian wine exports to China was up 19 per cent in 2012 so if Australian producers can differentiate themselves in the market, they can go some way to staying ahead of international competitors,” Mr Pearson said.

More details o the report can be found at http://www.nab.com.au/agribusiness

Given the work we are doing in China via our close associations via our media business See Global Media, I am often asked by friends what types of businesses, especially foreign companies, succeed in China. After research and reading over a few years I believe:

1) Businesses that understand their local market…China is massive and diverse…It’s not just one big country with lots of people

With the worlds biggest population China is a collection of different regional markets, each with its own consumer habits, finances and preferences. Businesses that understand this will do very well. For example, the most profitable store for Italian fashion house Giorgio Armani in China is in the city of Taiyuan, a third-tier city and major coal-mining centre in northern China.

Often rated one of the most polluted cities in the world, Taiyuan is a very long way from being a high fashion mecca. However, Taiyuan has a large concentration of multimillionaire coal-mine bosses who lack convenient access to duty-free shopping in Hong Kong because there is no direct flight between the two cities.

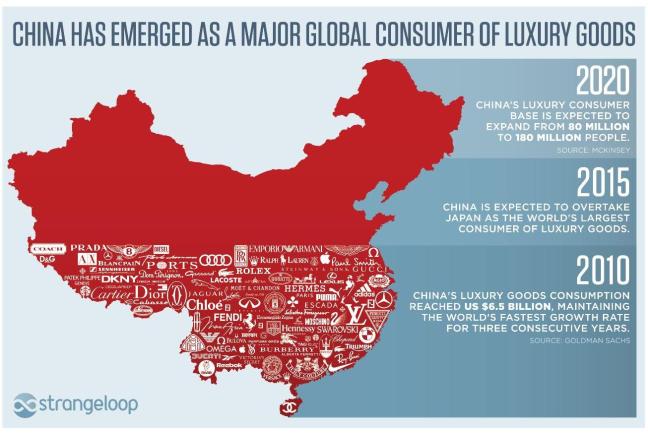

2) Businesses that offer status and/or value and provide the chance to display success

Chinese consumers tend to be extremely value-conscious and even more extremely status-conscious. They will not pay extra for something unless it has significant added value…and often that is about branding and packaging. Most Chinese are only willing to pay very little for basic everyday items, but are willing to pay much more for items or experiences that enhance their social status.

3) Brands that the Chinese trust and feel they can rely upon for consistency

Because of the large variety and complexity of Chinese food, most Chinese have a highly sophisticated taste for food. Consumers in China are rightfully very proud of their culinary heritage. Most Chinese consumers, rich and not-so-rich alike, prefer Chinese food over Western food.

U.S. based fast-food chains such as McDonald’s and KFC have done well in China NOT because their food tastes better. These Western chains succeeded because they are clean, convenient, cheap, consistent and safe. In a country where food safety is a major issue, consumers trust foreign companies like McDonald’s and KFC more than low-priced local restaurant operators.

The Chinese marketplace has become increasingly complex and challenging. It is not easy to succeed in China, but for those who do, the potential rewards are huge.